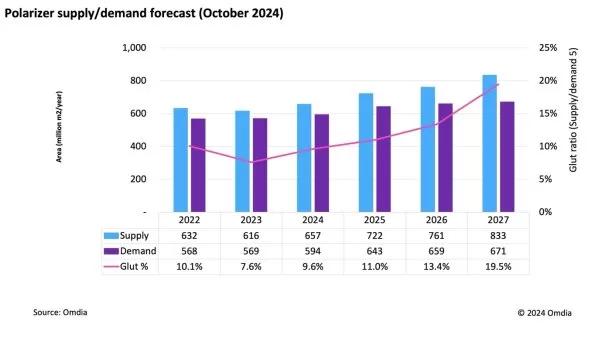

According to Omdia’s latest Display Optical Film Tracker, global demand for polarizers, a key component in LCD displays, is projected to reach 594 million square meters in 2024 and expand to 682 million square meters by 2027, growing at a compound annual growth rate (CAGR) of 3.4%. This growth is primarily attributed to the increasing consumer preference for larger-size televisions, driven by declining prices.

The production of polarizers is becoming increasingly centralized in China, mirroring the shift in panel manufacturing. Chinese firms have been actively investing in polarizer production, leading to concerns about a potential oversupply.

Omdia forecasts a stable surplus of 10% in 2024, gradually increasing to 19.5% by 2027. In response, leading Chinese polarizer manufacturers, including Shanijin Optoelectronics, Sunnypol, and HMO, have postponed their capacity expansion plans.

Meanwhile, Japanese and Korean polarizer manufacturers are streamlining production or divesting business units. LG Chem and Samsung SDI have sold their polarizer divisions to Chinese companies, while Japan’s Sumitomo Chemical is considering similar actions. These moves are expected to keep the polarizer market balanced until 2025.

However, long-term concerns about oversupply remain. Omdia’s modeling suggests that if delayed polarizer factories begin production in late 2026, supply could once again exceed demand.

The Omdia Display Optical Film Market Tracker provides detailed analysis of the display optical film sector, including mergers and acquisitions, production capacity, and supply chain dynamics.

ABOUT OMDIA

Omdia, part of Informa Tech, is a technology research and advisory group. Our deep knowledge of tech markets combined with our actionable insights empower organizations to make smart growth decisions.